DOWNLOAD TAN ALLOTMENT LETTER

Know the procedure on ‘how to download TAN allotment letter’.

Table of Contents

WHAT IS TAX DEDUCTION AND COLLECTION ACCOUNT NUMBER (TAN)

A Tax Deduction and Collection Account Number (TAN) is a ten-character alphanumeric allotted by the Indian Income Tax Department issued to person required to deducted or collect tax on payments made by them.

REQUIREMENT OF TAN

Under Section 203A of the Income Tax Act, 1961, it is mandatory to quote TAN allotted by the Income Tax Department on all TDS returns, TDS payment challans & TDS certificates.

PROCESS OF TAN

NSDL issue letter of TAN allotment letter to assessee on behalf of income tax department

HOW TO DOWNLOAD TAN ALLOTMENT LETTER

NSDL inform the assessee their respective TAN number through email or by post. In case, the assessee does not receive the TAN information. Then, the assessee can follow the following steps to retrieve TAN allotment letter is as follows:

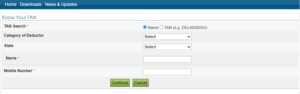

- Go to income tax website ‘KNOW YOUR TAN’. The following screen appears.

- Fill up Category of Deductor, State, Name and mobile number. Name and mobile number are a mandatory information to be filled up. Then, click ‘Continue’

- Insert the One Time Password (OTP) sent on the registered mobile number.

- Next, click on ‘Validate’

- The TAN details are displayed on the corresponding screen.

Also Read